If you think it can’t be done, call Martland Mortgages 01704 808 286

9am – 9pm Seven days a week

We’re all living longer and it’s not unusual to have multiple careers throughout our lifetimes so why shouldn’t mortgages be as flexible as your career?

Unfortunately, the bulk of lenders won’t lend into retirement. However, we have access to a carefully selected pool of lenders who are willing to consider mortgages until well after the usual retirement ages so get in touch and we may very well be able to help!

Lenders aren’t too concerned about what account you have but will need to see statements proving your income and giving a good representation of your outgoing expenditure on bills, entertainment & living!

It’s all about affordability these days and lenders want to be sure that you can afford to repay the loan, not just now but if your circumstances or mortgage rates change.

Lenders really don’t like to see evidence of Payday loans on your bank statements or credit history as to them, it looks like you may have affordability problems when it comes to paying your mortgage payments every month.

Ideally, leave it 1-2 years after your last Payday loan before considering a mortgage but we understand everyone’s circumstances are unique & individual to them so give us a call on 01704 808286 or make a mortgage enquiry and we’ll have a better of idea of what’s possible.

Why Using A Mortgage Broker Is A Good Idea

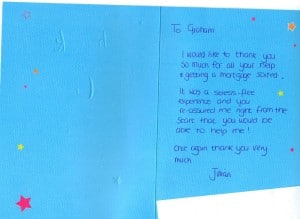

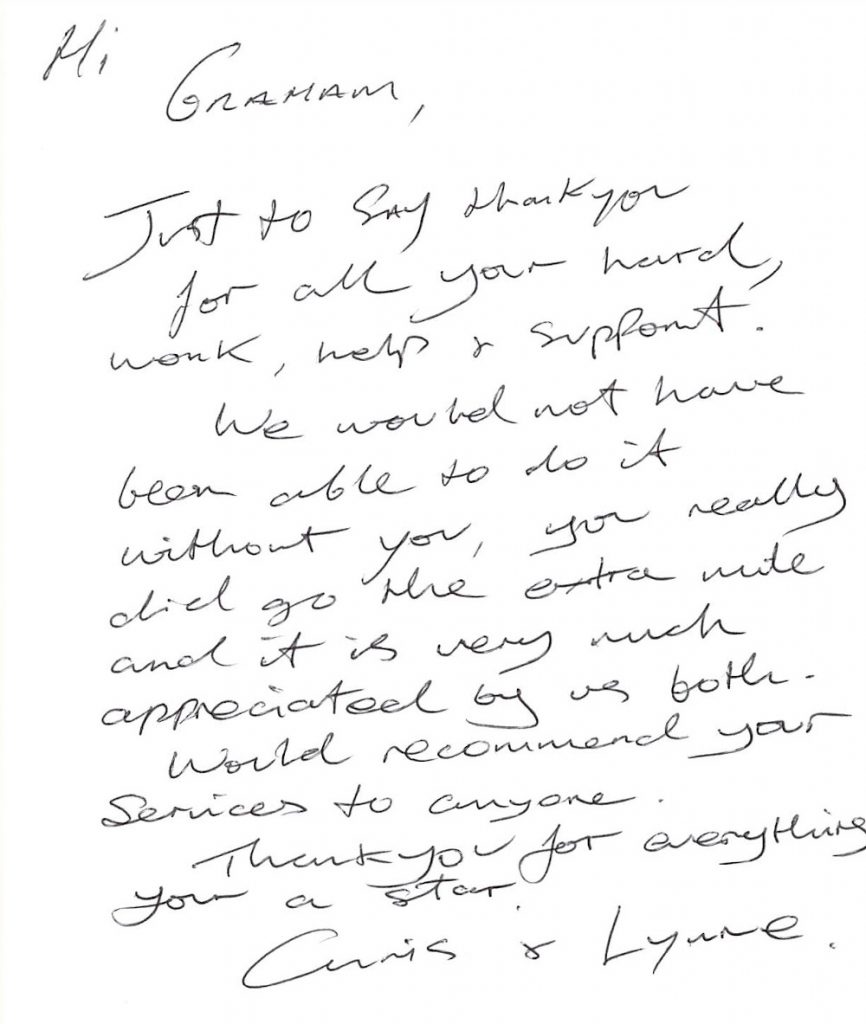

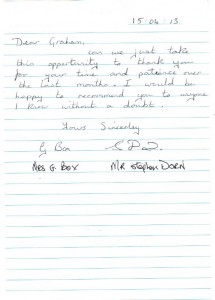

Getting a mortgage is a stressful time in anybody’s life, but it doesn’t have to be. Say hello to your knight in shining armour, the mortgage broker. Here to get you the best deal possible while making the process as painless as it can be, so keep on reading to find out why you should be using a mortgage broker.

Exclusive Rates and Offers

Mortgage brokers have access to exclusive deals that you won’t find if you search yourself. These deals aren’t on any comparison site and are only available through a broker due to the relationships they have built with lenders over time. Not only that, a broker takes the time to understand your own unique set of financial & personal circumstances and can advise holistically on the best deal for you.

By using a broker you get access to these deals and can take advantage of those relationships your broker has already built. You may get an interest rate that just isn’t available to the public or a great low-fee product that no one else knows of.

They Work For You

Go into a high street bank and the staff member who takes your application and shows you what mortgages are available is clearly working for the bank, what’s best for them might not be what’s best for you.

But go to a broker and they are working for you, not the bank. They want to get you the best possible deal as you’re their customer and getting their customers great mortgages is in the best interests of their business.

Access To The Full Market

If you go to your bank – or any other High Street Lender – looking for a mortgage, then all they’re going to offer you is the deals they have available right there and then. They’re never going to tell you about the amazing deal that’s currently on at a competitor, that would be business suicide.

But if you use a whole-of-market broker (we are), then you get access to the entire market. As a broker, we don’t just work with one bank, we work with many lenders, all with their own criteria, some of which are only available through brokers and we scour the market to get you the best mortgage deal possible. One that fits you, your needs & your family circumstances no matter how complex your finances may be.

Knowing the market goes beyond just getting a list of the cheapest deals on a comparison website, brokers can also advise on which lenders are likely to accept you and which lenders might reject you. Saving you time, the disappointment of a rejection letter and perhaps more importantly, an extra credit check on your credit file. The more of those that a prospective lender sees, the harder it can be to get that important mortgage decision in principle.

Hassle-Free

A broker takes all of the hassle out of getting a mortgage. Instead of all that worry and stress being on your shoulders, it’s now our problem, and even better, we’re great at solving those problems. It may seem like a disaster to you when a solicitor or lender demands a certain piece of paper at the last minute or discovers a chancel repair liability but to us, it’s what we do every day. It’s nothing we haven’t seen before and it’s our job to help smooth the way.

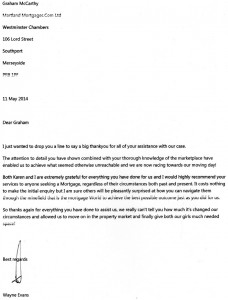

Special Circumstances

If you have special circumstances, such as self-employment, a poor credit file, you’re retired, ex-pat or buying an unusual property then often high street banks will just flat-out refuse you. They get so many applications that they don’t need the hassle and if you don’t fit in a neat category then computer says “no”!

But we’ve dealt with all this before. We know which lenders are keen to lend to someone in your particular situation and which ones are happier with another type of mortgage. So straight away, we’ll be placing your application with the lender most likely to accept, making your new home (or business premises) that much closer than you might think!

So, Tell Me Again – Why Use A Mortgage Broker?

A mortgage broker can get you deals that aren’t available to the general public, they also take all of the hassle out of applying for a mortgage and better yet, they can help your application get accepted. They are also incredibly useful if you have any special circumstances that may see you otherwise getting an automatic rejection on the High Street. It’s not unusual for Martland Mortgages to be able to place a mortgage with a High Street Bank that previously refused it – and we often get a better rate for our clients!